Each time our precious litre of gasoline costs a little more, there are often people to blame oil companies that would the sole resposible for this price increase. Is that so ? To answer this sensible question, the best is to follow the path of the money ! In France, a litre of gasoline is sold 1,47 euros when the barrel is around 100 dollars. And then:

- the added value tax sends 24 cents to the state budget (this tax is proportional to the price without tax), and the interior tax on oil products 60 cents (this tax is a fixed amount per litre). Altogether 84 cents are taxes (which is not enough according to my point of view !). With diesel oil, the interior tax on oil products is limited to 40 cents per litre, which is why diesel is cheaper. In Europe, the amount of taxes is very similar from one country to another, and this is due to history: countries that have begun the industrial revolution with plenty of oil within their borders have low prices of fuel (the US is a typical case), when countries that have begun the industrial revolution with imported oil have much higher prices at the pump (which is the case of European countries, the Northern Sea has begun to produce in 1973 or 1974 only).

- 7,5 cents are kept by the owner of the gas pump, which pays for the construction of the station, the salary of the employees, the transportation costs from the refinery, manitenance, etc ; the profit is generally lower than once cent per litre,

- the refinery keeps 4,5 centimes, and here also it corresponds to construction costs, operations and maintenance, etc ; the profit is much lower to once cent per litre,

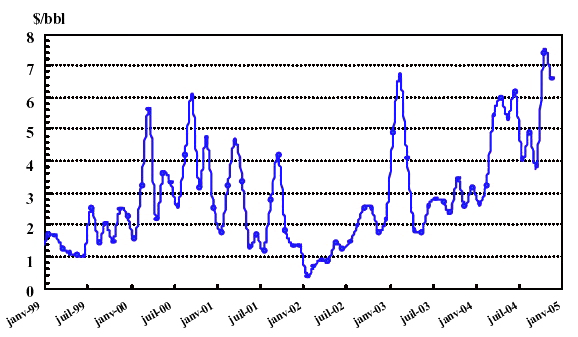

Evolution of the refinery margin in dollars per barrel (that is the sale price of refined products minus the cost of oil), from 1999 to 2005, in France.

6 dollars per barrel represents roughly 3,8 cents per litre.

Source : “L’Industrie Pétrolière en 2004”, Ministère de l’Economie, 2005

- the shipping company – or the owner of the pipeline – that enabled the transport of the oil from the well to the refinery keeps 1,5 cents,

- the state on which the well is located (called the “producing country”) keeps about 34 cents (which is a net income, as almost no direct expense are linked to this amount), and is by far the first beneficiary of the selling price of the barrel,

- the company that extracted the oil keeps roughly 16 cents, among which 9 cents correspond to direct producing costs (the rest is therefore a profit). Note that half of these expenses have been made by the company before the first drop of oil comes out of the well.

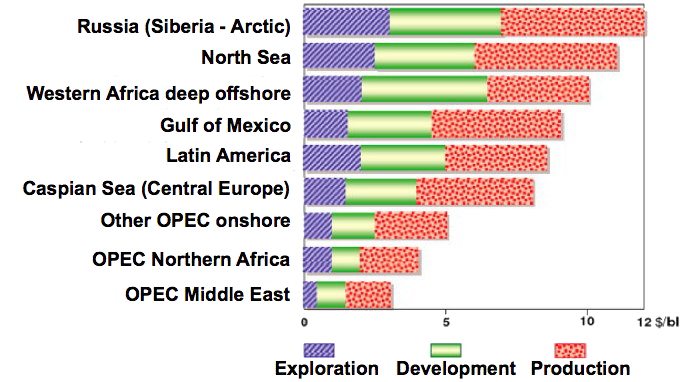

Technical cost of extracting a barrel of conventional oil.

Development is the building up of the extraction infrastructure.

Source : ADL, Long term Outlook, 1999, In Bauquis & Babusiaux, Adadémie des Technologies, 2007

The operating margin of the oil company is therefore around 7 cents per litre when the barrel costs 100 dollars, and for oil easy to extract (conventional, onshore, no “exotic” conditions). An oil company like Total, which has produced about 75 million tonnes of oil in 2006 (or 1,5 million barrels per day, or 87 billion litres per year), probably generates a gross margin of 6,4 billion euros for the upstream activity (on which it is still necessary to deduct general expenses, taxes, etc to come up with a net profit). Therefore suppressing the profit of oil companies would lower the price of gasoline in France by several cents per litre. It won’t change much the conditions of driving in my country !

Do not mix up the country of fuel consumption and the nationality of the oil company

Besides, most of the car fuel sold in a given country, say France, has not been produced with oil extracted by the company that has its headquarters in the same country (when there is an oil company in the country). Car fuels come from distributors, that buy refined fuels either from refineries located in the same country, or from import companies. Then the refiners buy oil – through traders – to all producers in the world, with origins that vary depending on the needs and prices.

The fact that the refiner is owned by a company that extracts oil elsewhere in the world does not create any link between the oil extracted and the oil refined. So a pressure put on the profits of the extracting company would not necessarily translate to a lowering of the price for drivers that have the same nationality than the oil company. That’s our world !