Among the various actions that are periodically suggested to slow down the rise of greenhouse gases emissions, a “carbon tax” is frequently evoked. What would be the principle of such a tax ? Simply that anything that leads to greenhouse gases emissions would be financially charged in order to dissuade – more or less – its usage, just as it is the case for tobacco or alcohol.

I won’t start now a long discussion on the fact that such a tax would be legitimate or not. I might just note, though, that it seems difficult to obtain whatever voluntary reduction of the emissions as long as there is no strong incentive this way and many incentives to go the opposite direction (advertising, “growth“, etc), and that a tax is a particularly efficient tool to allow virtue to be rewarded (since a virtuous behaviour is less taxed). It seems also important to say that one of the classical arguments against taxes (they induce extra spendings for “modest” households) can be answered the following :

- There are many solutions to avoid a social injustice when setting up a new tax (it’s possible, for example, to decrease another one at the same time),

- Albeit it is not at all politically correct to say what follows, the problem with climate change is that in industrialized countries, even a chain worker, a restaurant waiter or a small farmer have a “non sustainable way of life”, in the sense that they generate greenhouse gases emissions that exceed by far a “sustainable level”. In Europe, for example, everyone lives in a heated place, and almost every adult drives, and just this is enough to lead to excessive emissions). Considering that it will be possible to reduce the emissions of industralized countries without touching to the emissions of “modest people” is alas a illusion.

- At last, as the world is finite, emissions will decrease one day for sure. Among the alternatives to taxes (that bend the emissions curve) there is shortage, that has the same short term effect than taxes (prices go up), with the major difference that tax money does not leave the national ground (we take in one pocket to put in back in another, under the form of services such as health, education, etc), when an oil shock is money leaving the country for the producers’ wallet. A tax does not weaken the economy on a macro-economic basis (it helps those that provide the services funded by the tax, even if it is public service), when an oil shock does weaken the economy !

If such a tax was set up, was would be the opportunate level ? There is of course no unique answer to this question. In order to give meaningful figures I have chosen a high level of tax, that is very unlikely today : 1.500 euros (about the same amount in dollars) per tonne of carbon equivalent. In France, this would be equivalent to a doubling of the price of gasoline (now around 1 euro per liter, the price would rise to 2 euros per liter, what would represent 8 dollars per US gallon – the current price in France being 4 dollars per US gallon – and we live happily nevertheless !).

It is therefore a high level, but it is voluntary : amounts commonly evoked (100 to 150 euros per tonne of carbone equivalent, that is 5 to 10 extra euro cents per liter of gasoline) won’t bend the trends in a sufficient way considered what is the ultimate reduction to achieve.

Even if such a level seems high, I don’t know of any serious economic work that would prove that it would hurt human activity on a macro-economic scale (it would definitely hurt the energy consumption, but one should know what one wants !).

On the grounds of such a tax level, here are a couple of examples that might held to make one’s mind clearer. The values indicated are derived from the carbon contents that I had to calculate in the course of various personnal works.

Electricity

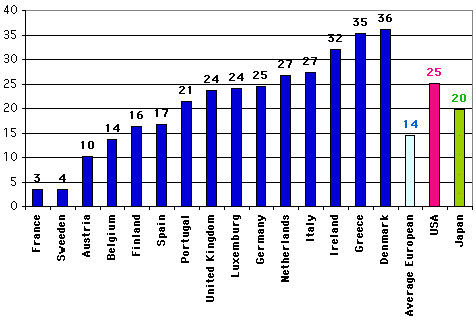

A french consumer would pay his electricity 3 euro cents more than today, but this amount would greatly vary from one country to another.

These differences come from the very variable amount of greenhouse gases emitted per kWh depending on the primary energy used in the power plant. If we distinguish by primary energy used, the price increase would be :

- in first approximation 0 euro cents per kWh for nuclear and hydroelectric plants (though dams might be sources of methane – which is a greenhouse gas – just like swamps and rice paddles !) and windmills (but these latter cannot be used autonomously, which raises an interesting methodological problem to determine the carbon content of the kWh they produce)

- 38 euro cents per kWh for coal produced electricity (that would be pushed out of the market)

- 18 euro cents per kWh for gas produced electricity (that would also be pushed out of the market !)

- a sum going from 2 to 4,5 euro cents per kWh for photovoltaïc (because of the emissions linked to the manufacturing of the solar panel)

This sole example illustrates pretty well, in my opinion, the very relative significance of the “competitivity” of such or such source of energy (statement often heard for natural gas). It’s easy to be competitive when damages (including the future ones) are accounted for zero in the price system ! It’s easy to see that charging a sum – certainly conventional, but not absurd – for the greenhouse effect inconvenient changes pretty much the hierarchy…

Transportation

Here are the price increases that a tax of 1,500 euros per tonne carbon equivalent would generate on transportation costs :

- in first approximation 0 euro for walking, cycling, taking a swiss or french train, or using rollers,

- for 15.000 km per year, in a small car, in town (average consumption 8 liters/100 km ; 29 miles to the US gallon) : roughly 1.300 euros,

- for 15.000 km per year, in a large car, in town (average consumption 15 liters/100 km ; 16 miles to the US gallon) : roughly 2.500 euros,

- for 50.000 km per year, in a medium/large car, in the country (any heavy driver for professionnal reasons ; average consumption 8 liters/100 km ; 29 miles to the US gallon) : roughly 4.400 euros

- for a return trip, by plane, between US and Europe : 1,100 euros more or less.

- the same trip by boat (without ending like in the Titanic) : about 10 euros.

Heating

How much more, then ?

- for 3.000 liters of fuel oil in the winter : about 3.600 euros

- if using natural gas, for the same amount of energy : about 2.800 euros

- if using electricity (the equivalent to 3000 liters of fuel oil is roughly 24000 kWh), it all depends, as it is easy to deduct from above. If all the electricity commes from coal fired power plants : almost 10,000 euros (but in France it is not the case !). If all the electricity is nuclear and hydro-produced : close to 0 …

- if using wood, coming from european forests (where wood is planted after being cut) : not much (it is necessary to deduct the emissions coming from timber and wood transportation, that roughly represent a couple euros)

Alimentation

Even what we heat would be subject to prices increases ! It is actually not very surprising when we know that in developped countries agriculture can generate a significant share of the greenhouse gases emissions (the first share in many countries like France, Ukraine or New Zealand., and I have not investigated all of them !).

- for beef : about 6 euros extra per kg of carcass when leaving the farmer (so probably more in shops) : bye bye pound steacks !

- for chicken or pork : about 1,5 extra per kg of carcass for real chicken (but only half for “industrial” chicken, the one for which bones can almost be used as chewing gum afterwards),

- for wheat : about 30 euro cents extra per kg, and for pasta about 40 euro cents extra per kg,

- for out of season products imported from the other hemisphere : about 5 euros extra per kg.

Generally speaking in season vegetables and fruits (and eggs) should not undergo major price increases (except when they are processed or heavily packed, see below) poultry and pork should increase a bit (around 1,5 euro per kg), cheese could increase by 4 euros per kg, and beef would increase a lot (twofold or threefold price increase).

Processed foods would undergo price increases between 1 and 10 euros per kg, depending on many things (and that does not concern caviar !).

Fruits and vegetables coming from very far (mangoes, lychees, but also green beans from Kenya) would be 5 euros higher per kg.

At last fish would increase between 0,5 and 3 euros per kg.

Manufactured goods or services

I did not do detailed calculations for everything we can find in a store ! (they are of course possible if the adequate data is provided). The figures below a just rough ideas.

- a small car, weighting 1 ton : roughly 2,200 euros extra ; a large car would cost up to 4,400 extra euros.

- a computer with a LCD display : about an extra 500 euros,

- building a 100 m2 (roughly 1,000 square feet) house : roughly 20.000 euros extra

- an insurance premium or a telephone bill of 1.000 euros per year : between 50 and 100 euros extra (depends on the carbon content of electricity that services use).

All these amounts might seem non reasonable, but one should keep something in mind : if 1.500 euros per tonne carbon equivalent is a high amount for a voluntary tax, it might well be way under reality if the reduction is not the result of a choice, but simply the consequence of an unwished regulation !