Here is a subject that would probably be most interesting for a philosophy exam ! But I hope that the reader will pardon me to discuss much more practical subjects than what would probably be expected from university students. Still, I will start with this definition of the dictionnary :

“Principle : fundamental rule on which a system is established.”

A principle is hence a rule that must be verified whenever we look at the subject to which it applies.

The “polluter-payer” principle, with such a definition, implies that as soon as there is a pollution somewhere, the entity from which it originates is supposed to assume the consequences of its behaviour, without any possible exception (otherwise it stops to be a principle !). In the name of such a principle, it is for example usual to consider that :

- farmers should pay for the nuisances inflicted to underground aquifers, and more generally for any excessive use of water, or any water pollution that exceeds the natural cleaning capacities,

- users of diesel cars should pay for the sanitary consequences caused by fine particles emitted by the tailpipes,

- plane companies and/or airports should pay to build protections against the noise in the neighboring of airports,

- boat companies and/or oil companies should pay for the consequences of oilspills,

- etc…

But are we aware of the consequences that would derive from a “universal” use of this principle, what should indeed be the case if it is a true principle ? Here are a couple of thoughs, to feed the discussion.

The “polluter-payer” principle may be pointless if the damage is beyond repair

What does it mean that it is possible to “repair the damages” ? Regarding damages caused to the environment, we might say that they are reparable if it is possible, from the degraded state caused by our pollution, to put more or less the environment “back in shape”, that is in a situation similar to that it had before we degraded it. Well there are plenty of cases in which this is simply not possible, like for example :

- disrupting the climate system, with the possible consequences that might result from it, because getting back to the pre-existing state will require thousands of years at least, and it is not excluded that it might amount to much more : discussing the possibility to put the things “back in place” is then pointless,

- supressing a species : it never came back to life once extinct. Suppressing the primary forests is a particular case of this irreversible damage,

- some degradations of the soil : if a soil is gone (for example taken away by repeated flooding when the vegetation is gone), one will have to wait 100.000 years to get a new soil from the underneath rock,

- some agressions against aquifers (there are fossil aquifers, for example, that are several million years old, and that don’t fill up once emptied),

- etc.

For all these damages, that are beyond repair whatever means we would wish to invest, collecting money to pay for “fixing” the damages has no sense. From there, the “polluter-payer” principle, applied to such cases, is only useful to deter a given behaviour. But then one should be careful about what follows.

The “polluter-payer” cannot be used to feed the general budget if the goal is to eradicate the nuisance

Making the author of the nuisance pay can also be used to dissuade him to act that way, just like we do for cigarettes or alcohol. Let’s assume here that this principle is invoked to impose a tax on a reprehensible behaviour : we will get a financial resource out of it, that will last just as long as the faultive behaviour and that will be of more importance if more people behave in a reprehensive way. This might induce strong perverse effects :

- If the objective is really to eradicate the nuisance, meeting that objective will simultaneously lead to the vanishing of the fiscal resource attached to it. So, if the entity that gets the tax uses it to feed the general budget, it becomes dependant on the perpetuation of the precise behaviour it seeked to slow down. The french taxes on car fuels offer a very good example : if tomorrow morning the trafic was cut by half, with a decrease of the consumption of oil products in the same proportions, it would be very favourable to the environment, but the fiscal revenues would be divided by half also, depriving the federal budget of 10 billion euros of revenues (excluding VAT).

- More generally, when a “reprehensible” behaviour is the source of a fiscal revenue, the entity that benefits from those revenues has no interest in a decrease of the nuisance if it does not bear, for a superior amount, the cost of the consequences. Let’s take again the example of taxes on car fuel :

- The federal budget does not bear the financial consequences of road trafic : the cost of accidents is paid by insurance companies (hence by drivers) and by the public welfare system (which is not part of the federal budget, and is funded by a specific system of contributions), the federal budget paying only the pensions of handicapped people and a couple of little somethings ; noise isn’t paid for by anyone, basically ; local pollution is not paid for by anyone either, except for the sanitary consequences that are also paid for by the public welfare system ; climate change will produce its consequences later and thus is not a source of spending right now (even though the hurricanes of 1999 or the various floodings of the recent years would be consequences of the human induced global warming, the federal budget is only paying a small amount of the consequences).

- These taxes constitute one of the first sources of revenues for the federal budget (bis)

- As a consequence, I am not persuaded that the state has whatsoever financial interest, at least in the short term, to try to lower the road trafic. We should find fiscal substitutes, and the present demagogy (promising at the same time an increase of the services provided by the public administration, and a lowering of the taxes) does not help to make such a move.

- But it is possible to progressively evolve towards a situation where a residual nuisance, at a level which is not a problem any more, is heavily taxed : the fiscal revenues generated can then last for a long time. It would be the case, for example, if road trafic was divided by 4 at least in France, with a correlative multiplication by 4 of the taxes on car fuels.

In short, imposing some taxes on a nuisance in the name of the “polluter-payer” principle can precisely prevent, afterwards, to get rid of it !

A couple of other possibly surprising consequences

Let’s imagine that as soon as there is a nuisance – now or later – the polluter has to pay for it, at a level that deters him (her) to continue, in order to eradicate the nuisance. Implementing such a rule in a systematic way would have the following consequences (I don’t discuss whether they are good or bad, I just underline some logical conclusions) :

- A strong increase of the price of food :If a farmer has to pay for every product he uses that pollutes, but wants to keep the same revenue (which, on average, is not very high in France), he has to charge the consumer – who is the ultimate beneficiary of agriculture – with the cost of pollution. Besides, less fertilizers and pesticides also means lower outputs in the short term. As roughly 70% of agricultural land in France (grasslands included) is directly or indirectly used to feed animals that we will eat later on, one of the consequences of the systematic implementation of this “polluter payer” principle, with a dissuasive level of taxation, would be a much lower availability of meat, that would become much more expensive.

I am personally favourable to such an evolution (the meat consumption per year and per person rose threefold in France from 1900 to 2000), as an important meat consumption is the main driver of the “nuisances” of modern agriculture, including its share in the greenhouse gases emissions. We may, as citizens, ask for the implementation of this principle, but we must then accept the financial consequences as consumers !

- An increase of the price of fish :Suppressing the fish stocks – which is a fact – is indeed a pollution.

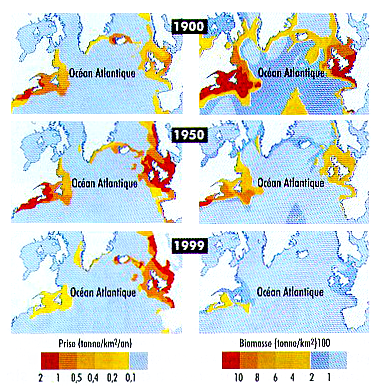

Catches (on the left, in tonnes per km² and per year) and remaining biomass (right, in hundred tonnes per km²) in the northern Atlantic, reconstituted for 1900, 1950 and 1999 by 23 different models from catch data.

One will note a division by 10 of the marine biomass in one century. Not bad…

Source : Science, 1999

If we impose some taxes – or quotas, which is economically equivalent, in the way that it incitates to produce less with a higher price per unit – on the fisherman to dissuade him from fishing too much, we will pay fish a higher price and get less of it. We will also pay a higher price all that derives from fishing, including goods as far from fish as poultry (industrial chicken are partially fed with fish flour !), milk (some cows are given fish derivates !), or…..raised fish, as it mainly concerns carnivorous species (like salmons, turbots, or basses), and thus only represents a displacement of the problem : it is necessary to catch wild fish to feed the raised fish…

- A division by 2, 3 or more, of the output of industrial goods ; the division by 2, 3 or more of some transportation services

Any company, today, emits greenhouse gases. This is indeed a pollution, since these emissions will disrupt the climate system, and this disruption will have adverse effects on many things. Households also directly emit greenhouse gases because of domestic boilers and car use.

If we want to voluntarily lower these emissions to a harmless level in order to prevent a “non reparable pollution”, it means, in France, that we should divide by 4 the present CO2 emissions (and divide by 12 in the US). Such a division of the emissions implies that we will have much less manufactured goods (and the industry will lower its activity), and much less transportation services, particularly by air and road. More generally, if any company emitting greenhouse gases (which is any company, really), had to pay a contribution for “future fixing of the climate system” in the name of the “polluter payer” principle, since there is no upper limit to the damage cost, every company would have to bear a contribution with no upper limit. Interesting, isn’t it?

Incidentally we will all pay car fuels at a much higher price, since we all are “climate polluters” when driving or flying, and we do not pay anything for this precise pollution right now. In France, though taxes on gas amount to 80% of the total price, the corresponding revenues do not cover the expenses deriving from driving (road building, maintenance, costs linked to accidents, urban pollution, noise, etc), and jet fuel bears no tax at all.

In short…

As we all are, as end-users, the beneficiaries of the activities that are a nuisance for the environment, even though we disapprove of these activities as citizens, we must come to the evidence : a broad implementation of the “polluter payer” principle is clearly equivalent to the fact that we accept to pay in order to preserve the planet and to the detriment of our short term material consumption.

One might consider that, as the planet is finite, a day will come anyway when our species will have to give up the present level of material consumption, because prolongating the trends for a couple of thousand years (this is what “sustainable” means ! and not just lasting for an extra 20 or 30 years) with a couple billion individuals on Earth consuming as much as today is not compatible with the known resources, and by far.

However, are all the supporters of this principle – many journalists, to start with, that often invoke this principle to criticize the lack of action of politicians – ready to bear the consequences of a broad implementation, including the above-mentionned examples? Open question…