Reserves and resources

Coal is an underground resource (anybody had any doubt ?). As for all resources that are mined (including gas and oil), when it comes to discussing figures we will use in turn three different notions:

- what is present below ground,

- what we are sure to extract in the future,

- and what will most probably be extracted in the future if we want to.

As for oil and gas, the proven reserves, that correspond to the first definition, is the only amount for which figures are widely published (or at least are published, even if it is not widely !). These proven reserves designate only the coal which is located in active mines, and that can be extracted at current economic and technical conditions (often local). No more than for oil or gas these proven reserves can include coal whose existence is absolutely certain but which is not located in an active mine (or sometimes a mine under development).

No more than for oil or gas the coal producer guarantees that the production coming from his reserves will be forever increasing or even constant. The best proof that it is not the case is that some countries publish proven reserves even though they have passed their production peak and have a declining production. As for for oil or gas, expressing proven reserves in “years of consumption” leads to the same wrong conclusion on the time we have before “something happens”.

As for oil or gas, there are other notions that are useful to designate part or all of the existing coal :

- Coal in place designates all the coal which is physically present in a given zone, regardless of any consideration on what is recoverable or not. This coal in place can still be given with conditions on the depth of the coal seams and their thickness,

- Ultimate reserves designates all the coal that can eventually be mined in a given zone (that can be the whole planet). It is therefore the cumulated extraction of coal, from beginning to end, in a given zone, if the only limit is technico-economic in an “open economy” (no wars, no strong regulation or ban, etc). The expression recoverable resources is also used to designate the same quantities. As for oil, the remaining ultimate reserves correspond to the ultimate reserves less what has already been extracted.

- And at last 2P reserves correspond to the best knowledge, ex-ante, of the ultimate reserves.

Besides the fact that it is solid (which obviously conditions mining operations !), coal presents another difference with oil and gas: the process that lead to its existence. This fuel is not a remain of plankton, but of terrestrial vegetation, and it did not migrate between a place where it was formed and the place where it can be found today. That leads to the presence of coal in the form of seams, that is layers that have been formed more or less horizontally and that correspond to the burrial of the original organic matter (mostly giant ferns). With coal, there is no such thing as reservoir rocks, with pores that contain the product we are interested in. In a coal seam, there is basically only coal, with a mineral fraction in the form of dust and small rocks which remains minor.

But otherwise mother Nature did not grant us with only seams that are 5 metre thick and located 2 metres below ground. There are seams of all thicknesses (a given seam can even have a thickness that changes from beginning to end) and located at all depths, up to several km. A general rule is that the deeper the seam, the best the coal. Indeed, as coal is burried by tectonics, when it is deeper it is more ancient and therefore has been “cooked” by geothermal energy for a longer time. As a result lignite is found close to the ground (less than a hundred metres), and anthracite can be burried up to several km deep (it can be less because of upwards movements of the Earth crust sometimes).

Question: should a seam 1 cm thick and located 5000 metres below ground should be included into the coal in place ? Because it is without doubt coal in the ground, and coal in place is supposed to include everything, with no consideration on the possibility to extract or not. This question (passionating, for sure) can find a different answer depending on the zone and the geologists.

Quite frequently coal in place is limited to seams that are at least 0,6 metre thick and located at less than 1800 metres below ground. But changing these values can produce a great change in the result, as shown below.

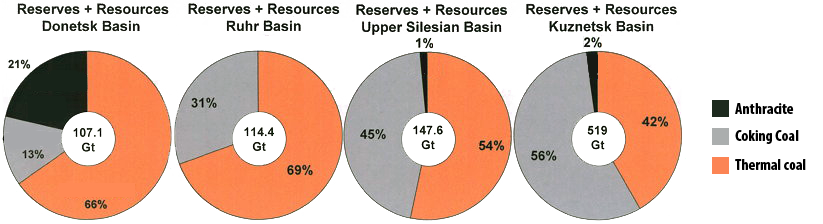

Coal in place for a number of coal provinces, including all seams that are more than 0,6 m thick and not deeper than 1800 below ground.

Same calculation when the seam must be at least 1,2 m thick and no more than 1200 m below ground.

The difference between the two calculations is 40% to 90%, which means that 40% to 90% of the total coal in place is located in seams 0,6 to 1,2 m thick or located between 1200 m and 1800 m below ground.</em>

Source Pierre-René Bauquis, Total Professeur Associés, 2008

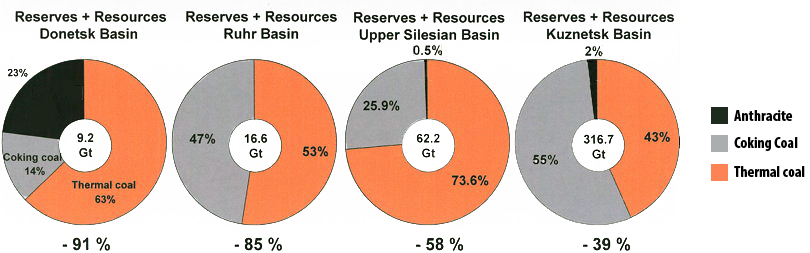

As there are little organisms that have compiled the world resources, with a thorough review of the methods used to assess coal in place, it is not that easy to have a good order of magnitude on the world coal in place, with a single definition. The graph below nevertheless gives an idea of the figures we are talking about.

Various figures regarding coal (world outlook):

- coal in place totals roughly 14,000 billion short tons (one short ton ≈ 0,9 metric tonne ; 1 short ton of coal ≈ 0,6 tonne oil equivalent) with no precision on the minimum thickness or maximum depth of the seam,

- the recoverable resources, also called “ultimate reserves”, precisely exclude the seams that will most probably never be exploited. They amount to 5,000 billion short tons

- proven reserves amount to “only” 1,000 billion short tons (which is close to the amount published by BP Statistical Review)

- and at last the cumulated production at the begining of the 21st century amounts to 280 billion short tons.

Sources : indicated on the graph.

When facing such huge figures for resources and much more limited amounts for reserves, two questions immediatly arise :

- how we go from one to another,

- whether these resources can be transformed in reserves one day (and therefore whether we could exploit them with technical costs that are compatible with what customers are willing to pay), irrespectively of the climate change issue that could justify that we do not use all accessible coal (which, in economical terms, could translate into a carbon tax, or regulations that aim at preventing preventing its use).

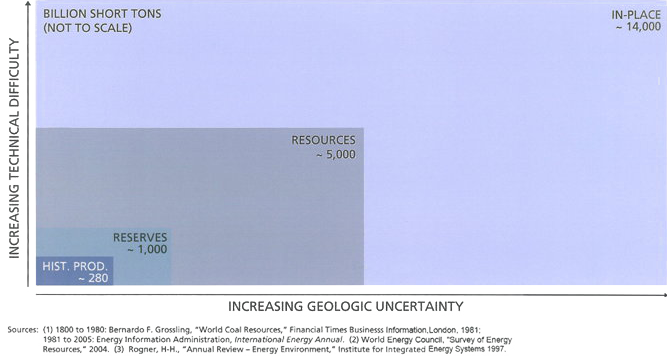

Various figures for various types of reserves in the US :

- there are 19 billion tons of proven reserves in active mines,

- there are 268 billion tons of proven reserves when including mines that could be active at current technical and economical conditions

- there are 493 billion tons of ultimate reserves (see definition above),

- there are 1,731 billion tons of identified coal in place (see definition above),

- there are 3,968 billion tons of probable coal in place.

Source : Energy Information Administration, 2004

Actually even when going from resource to reserve, which means that a coal seam falls within the perimeter of an active mine, the figure can change because of losses:

- seams that are too thin to be mined might represent up to 30% of the coal in place,

- some “bizarre” geological items, not detected before the beginning of mining operations, will prevent the extraction of an additional 10%,

- to prevent the mine galleries from collapsing, part of the coal has to be left in place in the propping up process (roughly 30%),

- the coal that has been mined must be washed, to remove all the mineral residues that are enclosed in the coal, and the yield of this phase is comprised between 50% and 90% (70% on average).

Going from the coal in place to the amount that can be extracted (in other terms the proven reserve) requires to multiply by 60% (to remove seams too thin and other geological surprises) * 70% (fraction of the coal that can be removed without galleries collapsing) * 70% (yield of washing) ≈ 30% of the initial resource.

Some other criteria can add up, which explains why a number of coal experts conclude that the ultimate reserves cannot go over 20% of the resource. Therefore, if the resource represents 14000 billion tonnes (see above), ultimate reserves will be comprised between 3000 and 5000 billion tonnes “only” (which represents 3 to 5 times the proven reserves published at end 2011).

One of the criteria never used to assess reserves is the energy required to mine the coal. On the opposite, it is most often this parameter that limitates the fraction of the oil in place than can be extracted from a reservoir rock. Indeed, extracting oil is forcing the circulation of a very viscous fluid through the very small pores of a rock, first through benefiting of the initial pressure of the reservoir, and then through creating this pressure from the surface. One day, doing so becomes too costly – first in the economic sense, then in the physicial sense – for the operation to be profitable.

For coal, even at thousands metres deep, the energy involved in mining operations is several % of the energy enclosed in the coal: it won’t be the first limiting factor !

Coal and coal

Coal burns, it seems. It must therefore contain things that are flammable, plus non combustible components, that will end up in the ashes. All this is perfectly true, and in addition to solid hydrocarbon coal also contains :

- water, between 1% and… 50%

- gases that have been adsorbed during the process of coal formation (CO2, methane, hydrogen, water vapour, argon….). They are imprisonned in the coal at a partial pressure close to the one that prevailed when they were formed, and bear the name of “volatiles”. They represent 5% to 30% of the total weight of dry coal (coal is “dry” when all water that evaporates at ambiant temperature has been removed. There is still water in the coal then, but in much smaller quantities).

- solid components that are not flammable (silica, alumina, iron oxides, quick lime, and various oxides), and that weight 5% to 30% of the dry coal.

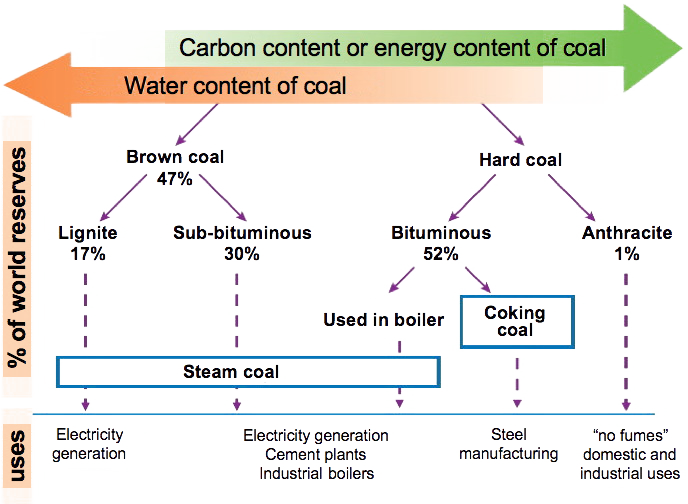

The flammable fraction of coal will therefore represent between 85% and… 20% only of the total weight of dry coal, depending on its quality. So there is coal and coal, in spite of the same word being used for all possible types of solid fossil fuels. It is therefore necessary to use sub-categories, which most often are the following :

- bituminous coals designate those that have the highest carbon content, and not too much ashes; the higher end of the bracket is called anthracite (almost pure carbon),

- sub-bituminous coals have a lower carbon content, with more ashes and water. They are younger than the bituminous coals,

- at the lower end of the classification we have lignite, with the highest fraction of water, the lowest fraction of flammable components, and the most ashes.

All these types of coals do not have the same energy content, and not the same usages.

Various types of coal, with the share in the world proven reserves, and the possible usages.

Source : IFP Panorama, 2010

As reserves agregate various types of coal, then the question of the good unit arises: should we use tonnes (which advantages low grade coals, that weight more per energy unit) or tonnes oil equivalent (that advantage high grade coals) ? The Devil can be in details here also, because when going from one unit to the other the result can be multiplied by 2 for a same country !

How are resources assessed ?

Resources are evaluated on the basis of distant geological informations (in other words on the basis of the type and age of the deep geological layers, with all the possible means). This approach does not allow to assess local thickness or quality variations, nor the geological discontinuities that can prevent an easy access to the seams.

Do reserves vary depending on the price of coal ?

As the definition of proven reserves includes an economic aspect (reminder: proven reserves is what is recoverable at current economic conditions), one should expert that if the market price of the resource increases, then the amount of reserves increases also. The good question is: by how much ? And the answer is that it depends on the resource.

For oil, there is a physical threshold to extraction: when the energy used to recover oil exceeds the energy enclosed in the oil extracted, what remains in the reservoir rock cannot be put into the reserves, whatever the price is. If this price increases, it does allow to use more sophisticated – thus more expensive – enhanced recovery techniques and to access more complicated fields, but it does not multiply recoverable oil by 3 (and most of all does not multiply by 3 the possible production, but rather prolongates a given level of production).

For conventional gas, this influence of price is even lower: a gas field is decompressed and when the field is abandoned there is less than 20% of the initial gas in place that remains, whatever the price is. An increasing gas price does not change much the amounts of reserves, the only significant influence being to allow the exploitation of “complicated” fields (deep offshore, arctic).

With coal, this energy boundary does not exist, even for seams that are thin and deep. The only limit to exploitation will be economical, and the more the mine is “complicated” (deep, in instable rock, with thin seams, etc) and the more work is needed, with a rising mining cost. This cost is very dependant on the level of local wages and varies between 30 and 200 dollars per tonne.

Besides a mine becomes active only if the coal can be sold, and in 2 cases out of 3 the client will be a power plant. Building this plant requires capital, which means that the increase of the proven reserves of coal also depends on the possibility to have new coal fired power plants be financed !

Where are the coal reserves ?

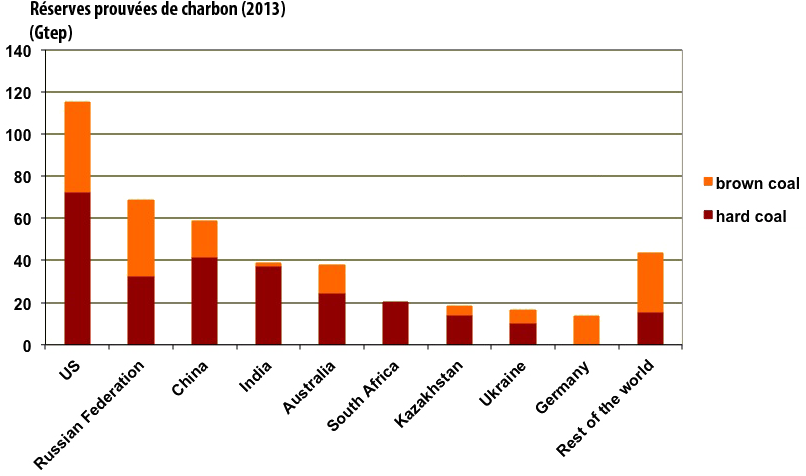

Coal sometimes has the reputation of being a fossil fuel better distributed than oil (where 2/3 of the reserves are in the Middle East) or gas (where 3 countries have half of the reserves). The situation is definitely more favourable to Occidental countries than for oil, but still 8 countries own more than 90% of the world proven reserves (and the first four own two thirds of the total).

Coal proven reserves by country, in billion tonnes oil equivalent, at end 2012, with a breakdown between hard coal and brown coal.

The first 8 countries own 90% of the world total, and even 94% for hard coal.

Source : BP Statistical Review, 2014

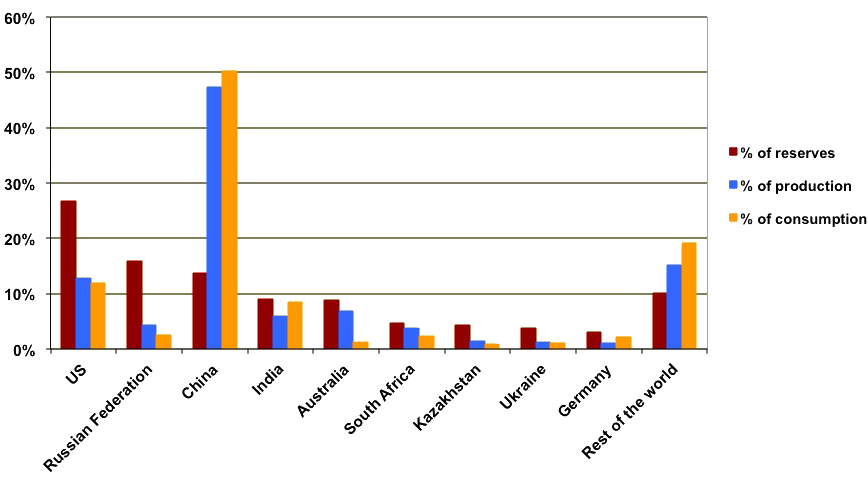

And if we talk about resources (that is coal in place), 3 countries (USA, Russia, China) own smething like 90% of the total ! (see below). But, as for oil, production and consumption are not ranked in the same order than reserves. Otherwise, as coal is mostly a domestic energy, with little international trade, consumption is located where production is located. What is similar to oil is that the highest production does not happen in the country that has the highest reserves.

Share of each zone in coal proven reserves, production and consumption in 2012 (the share is relatively to the reserves expressed in oil equivalent and not in tonnes).

Source : BP Statistical Review, 2014

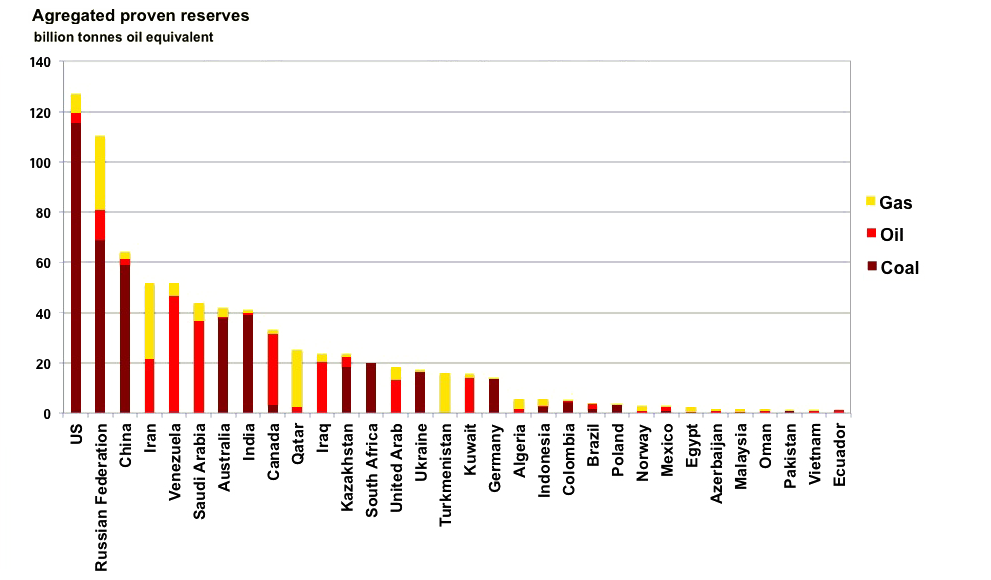

This distribution of coal reserves leads to a surprising thing: if we agregate coal, oil and gas, the two first owners of fossil fuel reserves are not at all Middle East Countries but… the US and Russia.

Proven reserves of fossil fuels, with all fuels for each country, for the top 31 owners of reserves in the world, in billion tonnes oil equivalent.

The largest owner of fossil carbon is… American ! (because of coal, for which the US has the first reserves in the world). NB: the oil reserves of Venezuela and Canada are mostly composed of non conventional oil (extra heavy and tar sands).

Source BP Statistical Review, 2014

How do coal reserves evolve ?

Somebody used to oil or gas will probably answer: they do nothing else than increasing ! Actually, it is much harder to get to a conclusion regarding coal, because available information is not consistent. It is the probable consequence of a data sharing which is even worse than for oil and gas, where it is already not an example of transparency.

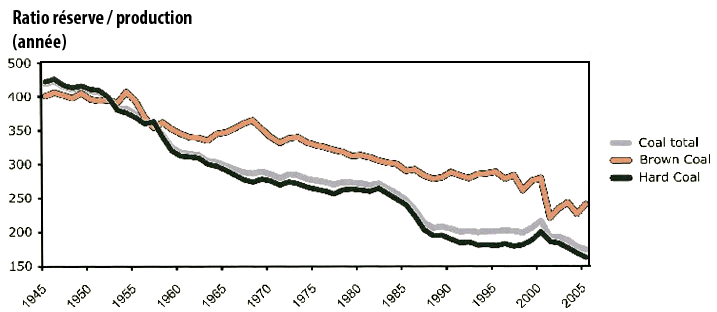

A first indication is that contrary to oil and gas, the ratio reserves/production, often wrongly named “years of consumption”, has been decreasing over the last half century.

Ratio reserves/production for the whole world from 1945 to 2005.

Source : Pierre-René Bauquis, Total Professeur Associés, 2008

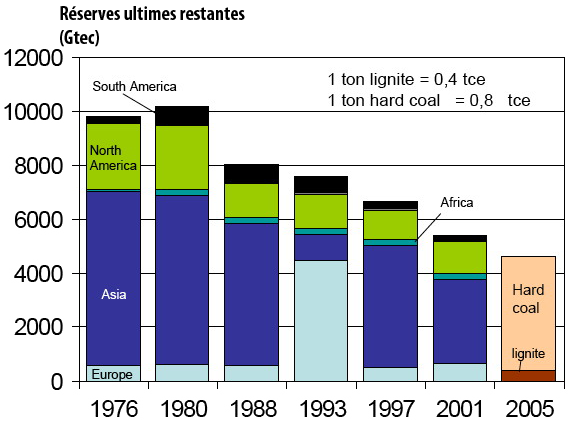

An information which is convergent is the analysis, by the “Bundesanstalt für Geowissenschaften und Rohstoffe” or BGR (German Federal Institute for geosciences and natural resources) of the evolution of the remaining ultimate reserves, which are constituted of the ultimate reserves minus what has already been extracted. These remaining ultimate reserves therefore represent all that could still be produced one day if the only limits are geological and economical, and they include coal that has not been discovered yet, or that has been discovered but is not exploited.

Evolution of the remaining ultimate reserves for the world, in billion tonnes coal equivalent, from 1976 to 2005 (one tonne coal equivalent ≈ 0,7 tonne oil equivalent).

The total has lost 5000 billion tonnes coal equivalent in 30 years when the cumulated production of the period is only 80 billion tonnes coal equivalent; 4500 billion tonnes coal equivalent ≈ 3100 billion tonnes oil equivalent.

Source : BGR, in Energy Watch Group : Coal, resources and future production.

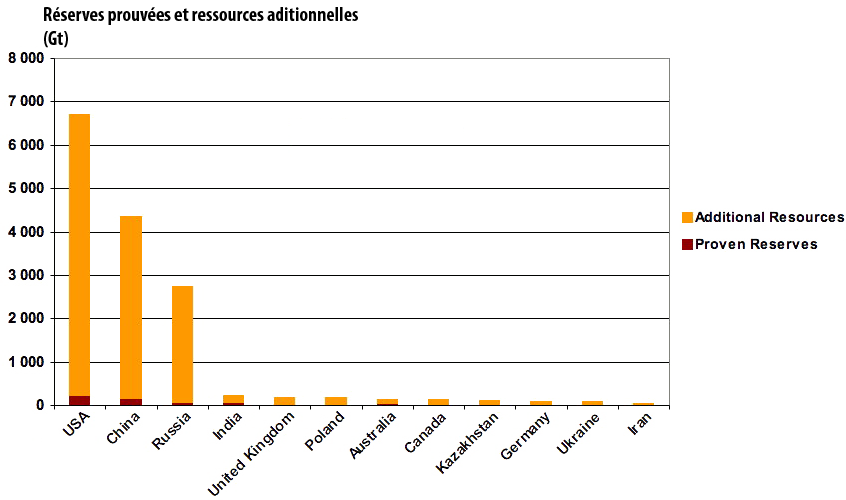

The same BGR publishes otherwise estimates of coal in place that are consistent with the above figures (remember that a division by 3 to 4 is done when going from coal in place to ultimate reserves), with a breakdown by country.

Proven reserves and additional resources (additional resources = coal in place less proven reserves) of hard coal and brown coal, lignite excluded, for the first 12 countries in the world, in billion tonnes.

To have a rough idea of the ultimate reserves, divide the amounts by 3 to 4 to account for the losses during mining (see above), and then by 1.5 to convert in tonnes oil equivalent (therefore dividing the figures by 4 to 6 gives the ultimate reserves in billion tonnes oil equivalent).

Source : Reserves, Resources and Availability of Energy Resources 2007, annual Report, Federal Institute for Geosciences and Natural Resources, Germany

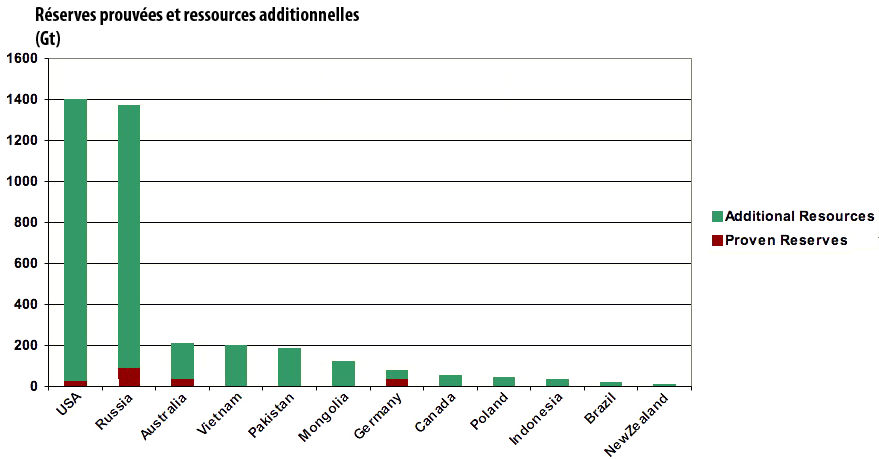

Proven reserves and additional resources (additional resources = coal in place less proven reserves) of lignite for the first 12 countries in the world, in million tonnes.

To have a rough idea of the ultimate reserves in billion tonnes oil equivalent, divide the amounts by 6 to 8 (lignite has a lower calorific value per tonne).

Source : Reserves, Resources and Availability of Energy Resources 2007, annual Report, Federal Institute for Geosciences and Natural Resources, Germany

Even if the figures are subject to debate, it seems that the amount of recoverable coal is pretty consequent, with almost 10 times what is published for oil or gas.

Are coal reserves checked by anyone?

There is no checking whatsoever by third parties of the figures that are published by mining companies. Another question ?