Simple and false ideas are not limited to oil. Just as producing oil is slightly more complicated than turning a tap plugged into a tank, producing gas – which by the way often comes from the same field than oil – is not as simple at it might seem.

Seeking gas

The beginning of the story for extracting – “producing” – gas is the same than for oil: a field has to be discovered ! And as oil and gas have been formed during the same geological process, quite logically exploration for both these fuels is done in the same place: sedimentary basins, that used to be covered by the sea, and in which little animals lived a happy life (so I hope !) before a ridiculous fraction of them ended in oil and gas. For a very long time, actually, findind gas was not desired during oil exploration, and gas was either a byproduct (when associated with oil, and when there was a local infrastructure to evacuate it and sell it to someone) or… a catastropha (when companies found reservoirs with gas only – dry gas – in the middle of nowhere, with no way to make it something close to oil in terms of price per energy unit).

As exploration for gas is done in the same places than for oil, with the same technical means, I will kindly ask the reader to refer to the page that deals with oil exploration for the beginning of the gas production story. Below I resume at the point where” something” has been found.

Eurêka (almost)

Here we are with a company that found “something” containing gas. And, surprise, a gas field is frequently… an oil field !

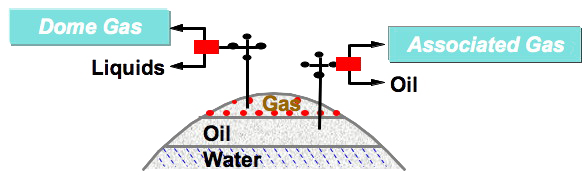

Simplified description of the three basic configurations for a “gas field”.

A gas field is actually a reservoir rock containing water, oil and gas in various proportions.

In the above configuration the rock contains water, oil and gas, the latter being both dissolved in oil (associated gas) for a part, and free in the field for another part (“dome gas”).

The expression “associated gas” is used to design the fact that some gas will come out with the oil, and the two will have to be separated in surface installations.

This configuration happens when the amount of gas enclosed into the field exceeds what can be dissolved into the oil with the local temperature and pressure conditions.

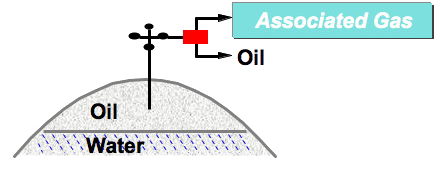

In the above configuration, the reservoir rock also contains water, oil and gas, but the the latter is completely dissolved into the oil (associated gas).

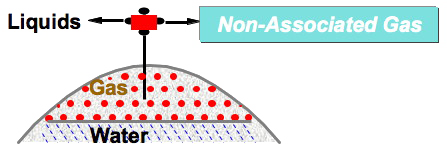

In the above configuration, the gas is “dry”: there is no oil in the rock, just gas and… water, in spite of the adjective “dry”.

The gas is therefore not dissolved in a liquid.

It is therefore very frequent to extract oil and gas at the same time..

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

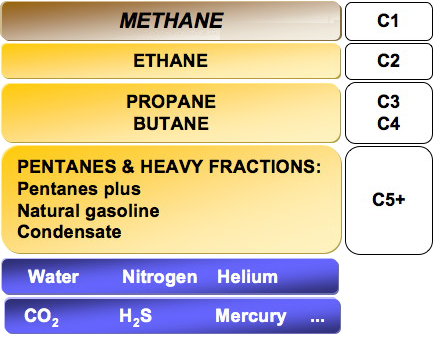

The gas that lies in the field contains of course methane, its principal component, but not only: there are also hydrocarbons with longer chains (with 2 to 5 atoms of carbon essentially) and various gases that are not hydrocarbons (CO2, H2S, nitrogen…). It’s normal: gas (and oil) being a residue of ancient life that migrated into a rock, the field can contain all the elements that were present in the initial plankton or that went taken along when oil and gas migrated from the mother rock to the reservoir rock.

Composition of crude gas (as it comes out of the field).

Hydrocarbons range from methane to pentane and more. The commercialized gas is almost pure methane (with a smelly additive to easily detect leaks before explosions !).

Propane and heavier molecules are separated and sold as LPG (liquefied petroleum gas) or NGL (Natural Gas Liquids). The heavier fraction of these gases, that is liquid when sold, is also called “condensates”.

Incidentally one will notice that helium is a byproduct of gas production, which makes it impossible to replace planes with balloons inflated with helium when we run out of hydrocarbons !

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

One the field has been located, and the presence of gas confirmed with one or several exploration well(s), then it is necessary to do as with oil: build a production well “real size” to test the flow, then production itself can start. It consists in extraction, on site treatment, transport, and distribution.

Extraction

Extracting gas is actually pretty simple: it’s a decompression process. The gas in the field is under high pressure (just as the worker of the oil company sometimes !), even if it is dissolved in oil, and the simple fact of creating a hole in the reservoir rock (with the well) pushes gas up to the surface. The height of the gas column in the well does not create a high counter-pressure because of the low density of gas.

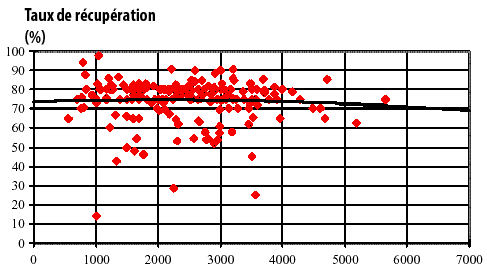

Because of the physical process involved in gas production (a pressure decrease), the recovery ration of gas in a field is much higher than for oil, as almost 80% of the gas in place is generally recovered, when it is 35% on average for oil. Only non conventional gas fields escape this rule. In other words, for conventional gas the difference between the gas in place and ultimate resources is 20% to 25%.

Recovery ratio for all gasfields (dry gas only) that are deemed to contain more than 30 billion cubic feet of gas in place.

The horizontal axis gives the size of the field in billion cubic feet and the vertical axis the recovery ratio.

It is easy to see that this ratio is much higher than for oil.

Source : Jean Laherrère, 1998

The fact that the extraction process is simple has a little side effect: it is hard to have a good surprise ! Indeed, for oil, any technical improvement that allows to improve the recovery ratio by 1% (going from 33% to 34% for example) increases by 3% the oil puped out. With gas, besides the fact that there is no silver bullet to create anew a high pressure in a reservoir rock almost completely depleted, an improvement of 1% of the recovery ratio allows to increase… by 1% the amount extracted.

As for oil, to maintain a constant production a company must constantly develop new projects, since those producing will yield a decreasing amount of gas over time.

On site treatment

As seen above, crude gas does not contain only methane. It also includes various components that had better be removed before the gas is sent into a gas pipe or a liquefaction unit :

- molecules that are liquid once under pressure (condensates), that would therefore restrict the circulation of gas in pipes. As they have a high economic value, they are separated from the gas itself just after the well, and transported as liquids,

- water and CO2, which are corrosive mixed together: once CO2 dissolves into water, it forms carbonic acid, that corrodes pipes (by the way it’s exactely the same process – dissolution of CO2 into water – that leads the ocean to become more acid as a consequence of our exces emissions of CO2). Water and CO2 have therefore to be removed,

- gases without any energetic content (nitrogen and again CO2), that the company is not really willing to spend money to carry hundreds or thousands of miles away just for the beauty of it !

- gases or products that are toxic or nuisances (mercury, H2S, etc), and that are also removed,

- byproducts that have a high commercial value (like helium) and that are sometimes isolated on site (not always, for helium it takes a particular plant).

Separating all the components of gas costs several cents (up to 25) per million BTU (One million BTU ≈ 1 GJ ≈ 280 kWh), in a production total of 0,2 to 4 dollars per MBTU. The rest of the cost corresponds to exploration, the construction of production infrastructure (wells, pipes, storage, etc), facilities for the workers, etc.

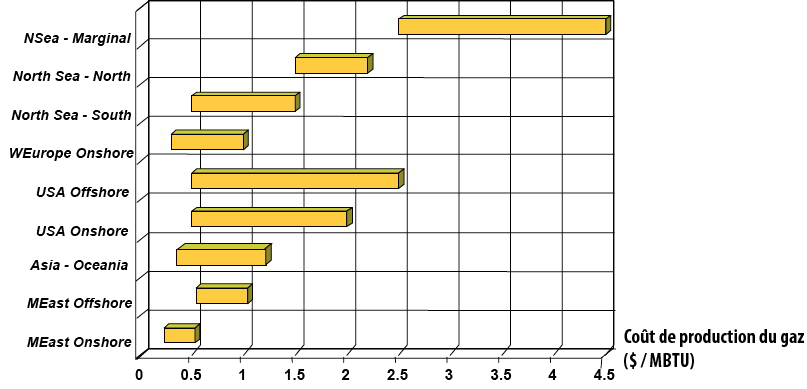

Production costs of gas, in dollars per million British Thermal Units or MBTU.

One BTU equals roughly 1000 joules, and therefore a MBTU equals roughly 1 gigajoule, or slightly above 250 kWh. 1,5 dollar per MBTU is roughly 0,5 cents per kWh (or 0,4 cent of euro).

The treatment of the gas on the production site (in order to separate all its components) represents 5 to 25 cents per MBTU, or roughly 10% of the total cost.

To get the price in dollars per barrel oil equivalent, roughly multiply by 5 the price in dollars per MBTU. For example the production cost of gas onshore in the Middle East is 0,5 dollars per MBTU ≈ 2.5 dollars per barrel oil equivalent. We see that it puts gas production costs in the range of oil production costs.

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

Transportation

Gas has a major inconvenient: it is gaseous. Therefore, at ambiant pressure and temperature, there is one thousand times less energy in a cubic metre of gas than in a cubic metre of oil. And because of this physical characteristic, hardly modifiable in the future, transporting gas is more complicated and costly than transporting oil.

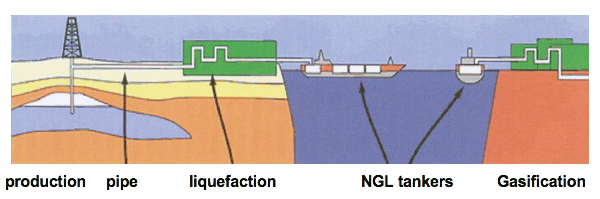

When the distance is not too important, the cheapest means is gas pipe: it then costs less than 1 dollar per MBTU, which is roughly 1 cent (of euro) per kWh. Then came the development of transportation under the lioquid form, as described below.

Simplified representation of a gas transport with liquefaction.

The liquefying plant typically costs 1 billion dollars, and the gasification terminal half a billion.

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

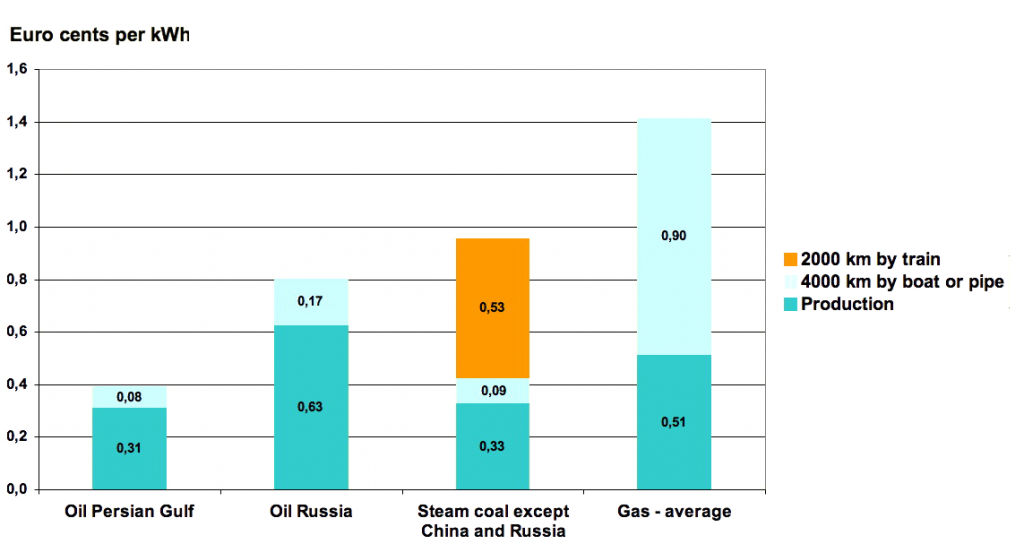

In all cases, production cost fall below transportation costs when the distance is significant. It explains why gas is a regional energy, the only intercontinental trade being with LNG.

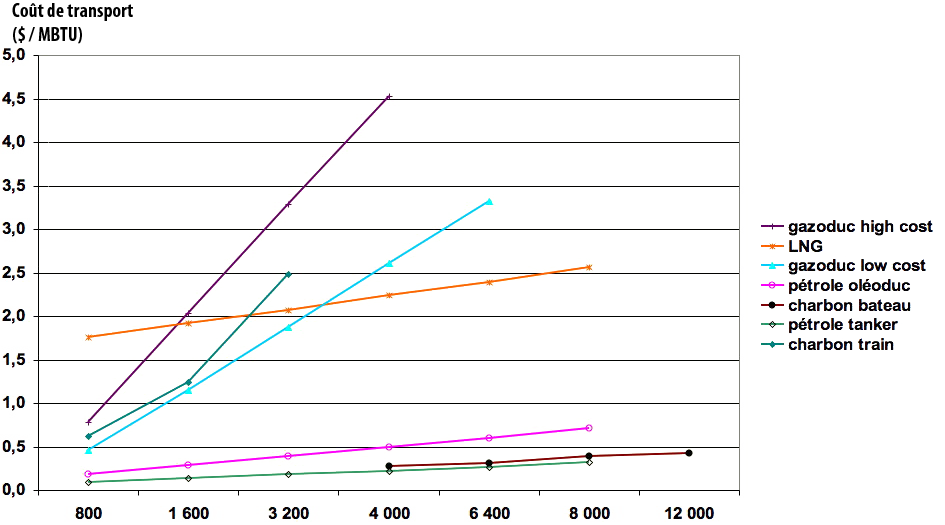

Indicative costs of transportation for various fossil fuels, in cents (of €) per kWh.

The transportation cost for coal can include boarding or disembarkment costs that are not included here.

We see that oil is by far the cheapest fuel to transport (and coal pretty cheap to transport by boat but not at all by train).

Source : Author’s calculations upon various sources

Cost of transportation for various energies, in dollars per million British Thermal Unit, depending on the length of the trip, in km (on the vertical axis, and beware because intervals are not equal).

One million BTU ≈ one gigajoule ≈ 290 kWh. To get figures in euros per MWh multiply the figures in dollars per MBTU by 3.

LNG means Liquefied Natural Gas.

Transporting gas costs 5 to 10 times more, per energy unit, than transporting oil by any means, or coal by boat. It explains why gas is the last fossil fuel to have become internationally traded in significant volumes.

Sources : Pierre-René Bauquis, Total Professeurs associés, 2008 & Jean Teissié, 2001

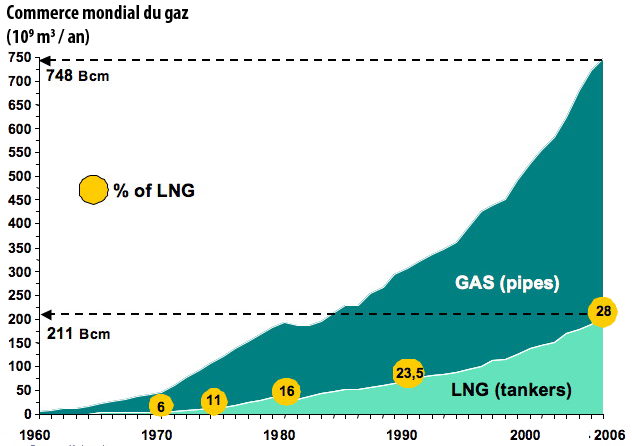

Today LNG represents 30% of international trade, which itself represents 30% of the world consumption…

Share of each type of gas transport in the world trade, in billion cubic metres per year.

In 2011 the world consumption was 3200 billion cubic metres (or 32 000 TWh or 2,9 billion tonnes oil equivalent).

The international trade was 1000 billion cubic metres in 2011, with LNG representing 30% of that amount, or 10% of the world consumption.

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

As seen above, liquefying gas costs at least 2$ per MBTU (and often 3 to 4), that come on top of production costs. Therefore, if for whichever reason gas price becomes lower than 3$ per MBTU (which means that locally or regionally produced gas transported by pipe can be sold that cheap) then any infrastructure build to allow imports by LNG tanker are out of business. It is exactely what happened recently in the US because of non conventional gas.

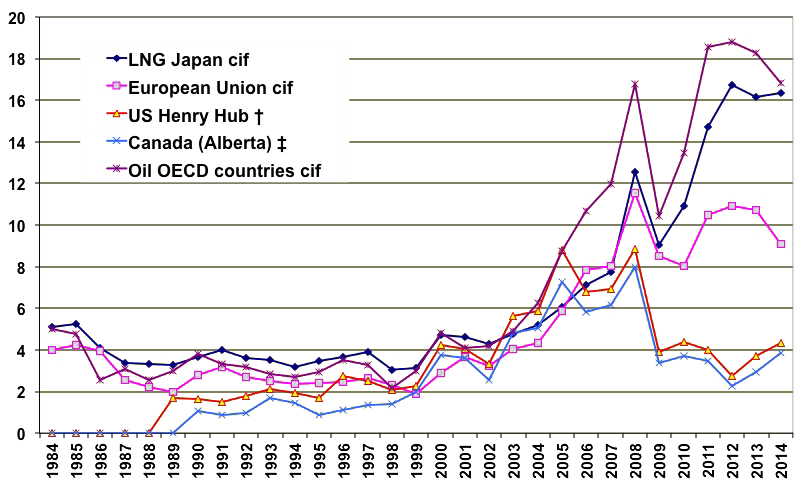

Respective evolutions of the spot price of gas for several markets, and oil, in dollars per million BTU

(le prix spot est le prix d’achat immédiat).

(1 million de BTU ≈ 0,3 MWh)

(CIF signifie Charged Insurance and Freight ; c’est le coût complet du combustible parvenu à destination avec manutention, fret et assurance).

LNG Japan = import price of liquefied gas in Japan

European Union cif = average gas price in Europe

Henry Hub & Alberta = gas markets in the US

CIF means Charged Insurance and Freight; it is the full cost of the fuel for the buyer with boarding in the shipping country, freight, and insurance.

We clearly see the evolution of gas prices in the US that departed from what happens in the rest of the world as the result of the rapid rise of non conventional gas.

Source : BP Statistical Review, 2015

Storage

In most gas consuming countries, that are mid-latitude countries, part of the gas is used for heating, thus with a seasonality. The most obvious answer would be to ask the producer some flexibility in the supply, but it is not this way they manage production (almost constant all year round). Therefore a supply contract generally stipulates that the amounts of gas delivered are almost constant all year round also, and the consumer manages on his side the change in consumption.

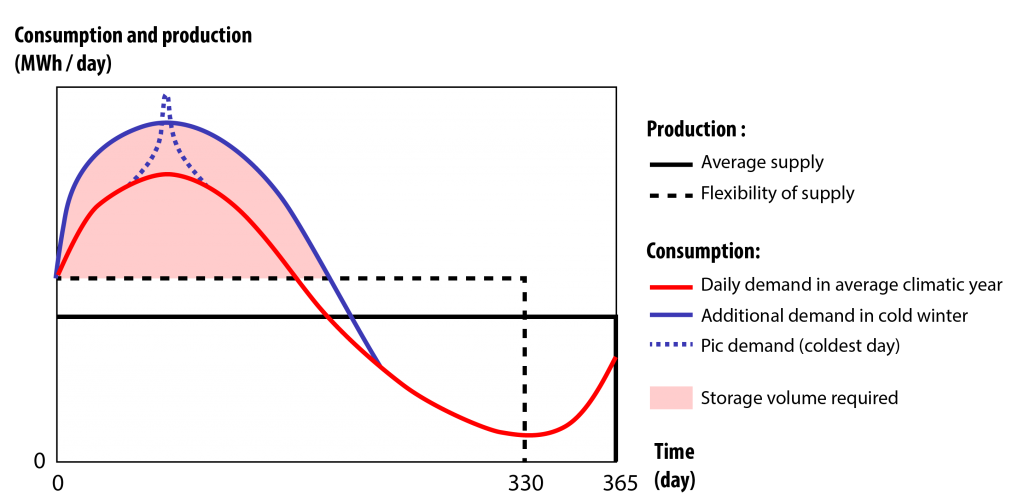

It is therefore necessary to built storage capacities in the consuming country, to go from a constant supply to a season-based consumption.

The curves on the above graph show respectively, along with time, figured on the horizontal axis:

- the supply coming from the producing countries, which is almost constant in time (“average supply”). It can be slightly modulated, but not that much (“flexibility of supply”).

- the consumption curve for a typical country of the mid-latitudes (in thick blue). When the winter is cold, then the consumption corresponds to the red curve,

- In winter, the supply is not sufficient to feed the demand, and therefore some intermediate storage has to be set up in the consuming country. The volume that has to be stored is the cumulated difference between supply and demand for the whole winter and corresponds to the pink area. This type of storage must be of great capacity but the flow (respective to the capacity) must not be massive,

- If, during a cold wave, there is a peak in demand (in green), then it is necessary to get some extra gas, with an important flow, but over a short period of time. The corresponding type of storage is very different from the first: low capacity, high flow.

Source : Pierre-René Bauquis, Total Professeurs associés, 2008

For massive capacities and moderate flows, the gas distribution company generally uses underground storage (depleted gas fields, caves in salt domes, other type of air-tight cave…). For peak demand over short periods of time, the storage capacity is generally a surface installation, made of tanks and pipes !

Usage

Once in the consuming country, gas will be used, that is… burnt, except for the small part used as feedstock in chemical industries. All these billion dollars just to get a flame !

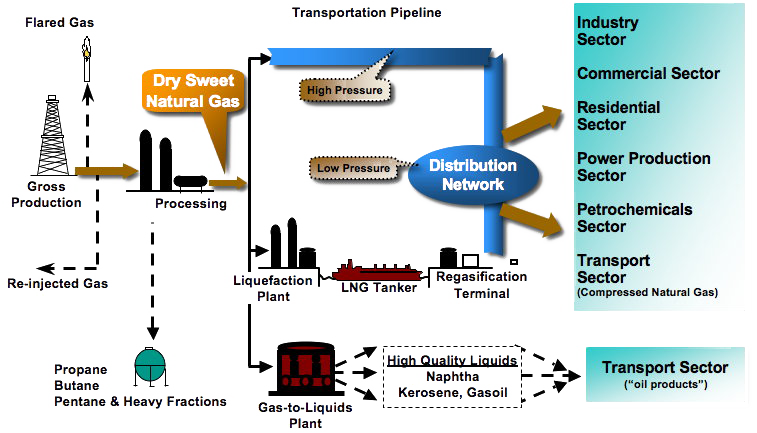

Synthetic description of the full gas production and transport chain.

“Flared gas” désignates the gas burnt on site “fir nothing”, which is done when this gas can neither be economically transported to consumers, nor injected to enhance recovery of oil in case of a joint exploitation. When gas can be “re-injected” it is mentionned as such.

Auteur : Pierre-René Bauquis, Total Professeurs associés, 2008