As companies that explore for gas – then produce it – are the same than those which explore for oil then produce it, discussing gas reserves uses the same technical expressions than those used for oil :

- gas in place designates all the gas present in the reservoir rock, with no discussion on the fraction that will eventually come out,

- proven reserves designates all the gas that the company declares as recoverable under the current economic and technicial conditions. No more than for oil the company guarantees that this gas will be produced with a growing or a constant output, and therefore expressing them in “years of consumption” leads to the same mistake than for oil. No more than for oil proven reserves can include gas enclosed in fields that are not already exploited.

- ultimate reserves correspond to all the gas that will eventually be extracted from a field (or a full province, or the whole planet).

- 2P reserves correspond to the most probable value, ex-ante, of the ultimate reserves.

As the rest of this page will essentially underline the differences between oil and gas, it might be useful for whoever will read these lines to first take a long look at the page on oil reserves, without forgetting that oil and gas are often both present in the same fields.

Quantification of volumes

For oil, as proven reserves are calculated for already producing fields (or about to produce), one of the most valuable information is the flow of the existing production wells, and for gas the general idea is about the same. But the prediction of the future flow (the full volume that will be extracted in the future is nothing else than the cumulated future flow) from the present one is more complicated for oil than for gas. For the latter, production basically consists in decompressing an underground reservoir rock. Therefore, as soon as the gas production has generated a significant decrease of the underground pressure, the remaining recoverable volumes are pretty well known.

Therefore reevaluations of proven reserves from producing fields are not as important as for oil. To increase the proven reserves, it is therefore necessary to discover and develop new fields. And for discoveries it happens that the situation is close to what it is for oil: it’s been roughly 40 years that gas discoveries have peaked, and they are now steadily decreasing.

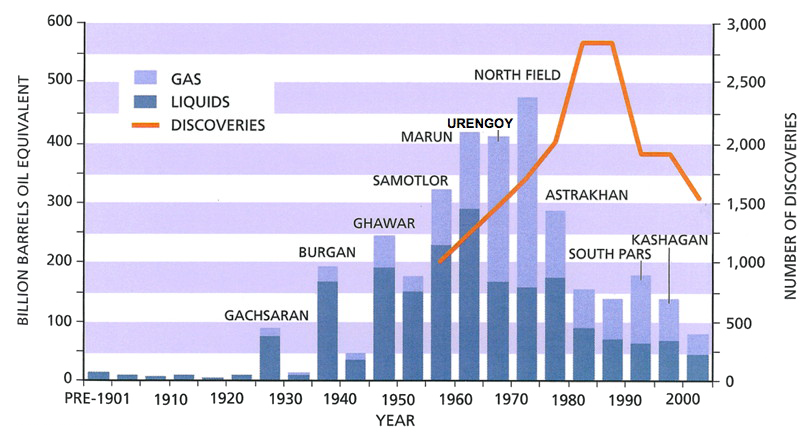

Evolution of the world recoverable oil and gas discoveries (we are talking here of the 2P evaluation, done at the date of discovery), except US and Canada.

The left axis is graduated in billion barrels oil equivalent, and corresponds to the blue bars, that give the volumes discovered for each 5 year period.

The right axis is graduated in number of fields discovered, and corresponds to the orange curve that peaks 15 years after the volumes discovered.

As the case may be, the name of the largest field discovered in a 5 year period is mentionned above the bar that corresponds to the same period (for example Burgan and Ghawar are giant oilfields, Urengoy, North Field and South Pars giant gas fields).

The reader will notice two things well known of oil geologists but not as much by the general public :

- It’s been 40 years that we have passed the peak of discoveries for gas (and 50 years for oil), and now the discoveries are way below production (but it does not prevent proven reserves to go on rising, because of other reasons, maybe including… bluff!),

- The number of fields discovered each year is the same today than in the 60’s, but volumes are 4 times lower, which means that the average size of a field discovered is 4 times smaller than then.

Source : IHS energy, 2006

If we combine decreasing discoveries with the fact that there is little room for future reevaluations in the fields already producing, we should conclude that gas does not allow for this reserve growth that oil has given in spite of the fast decrease of discoveries.

But non conventional gas adds a degree of complexity, with reserves that are low – the future production that is guaranteed from existing wells is always small – but a production that can nevertheless remain significant with new wells drilled all the time.

Where are the gas reserves?

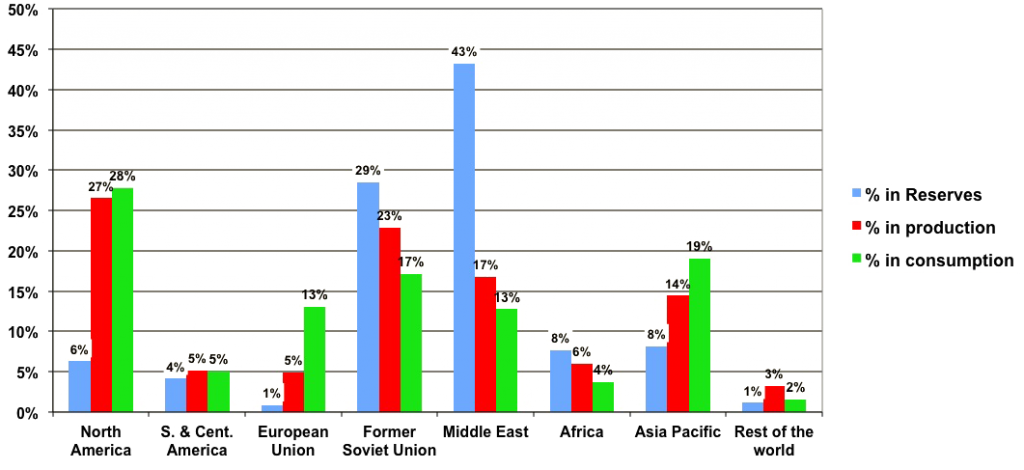

As for oil, gas is not really evenly distributed among countries. Middle East comes first, but the second zone is not as far behind as it is for oil. But, as for oil, the European Union consumes a gas that it doesn’t have!

Share of each zone in proven reserves, production and consumption in 2013.

Source : BP Statistical Review, 2014

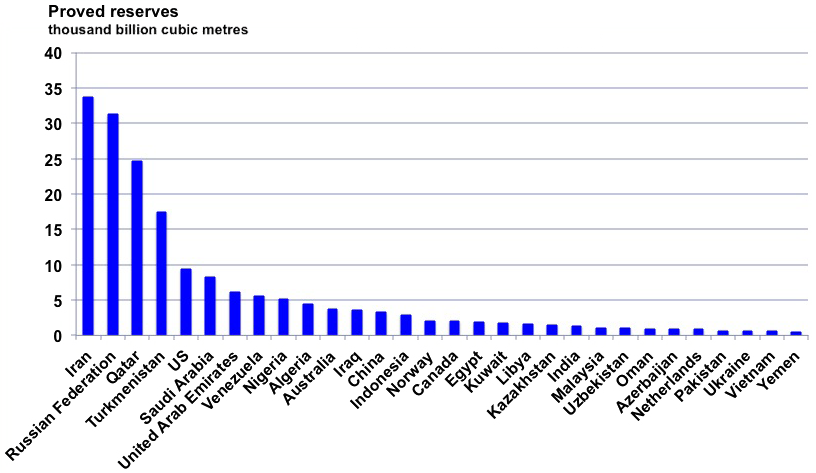

If we rank countries by decreasing order, the “gold medal” goes to either Russia or Iran depending on the year. And Iran and Qatar actually share a giant field that spans across the two countries, so deciding who has what remains a delicate exercise.

Gas proven reserves by country in 2011, in billion cubic metres.

The first three countries represent 50% of the world total, the first ten 80%. The European Union and Norway altogether represent the equivalent of Australia, or 2% of the world total.

Source : BP Statistical Review, 2014

How did the reserves evolve over time?

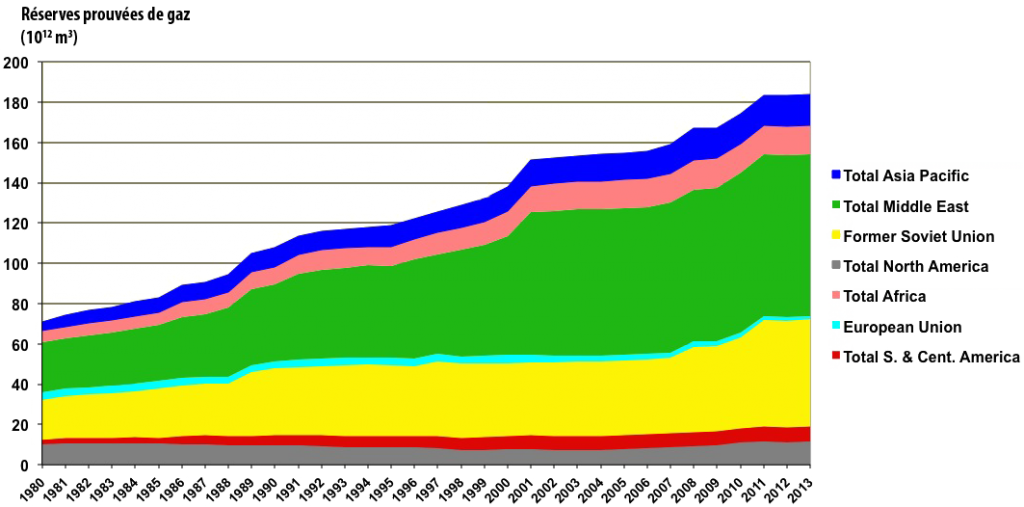

As for oil, proven reserves obey a law which is “never decrease”! But discoveries are more recent, and there is no “OPEC effect” since there is no organization gathering gas exporters.

Evolution of the proven reserves by zone, in billion cubic metres.

Source : BP Statistical Review, 2014

One should also note that North America has been the first gas producer in the world for decades while having very low proven reserves.

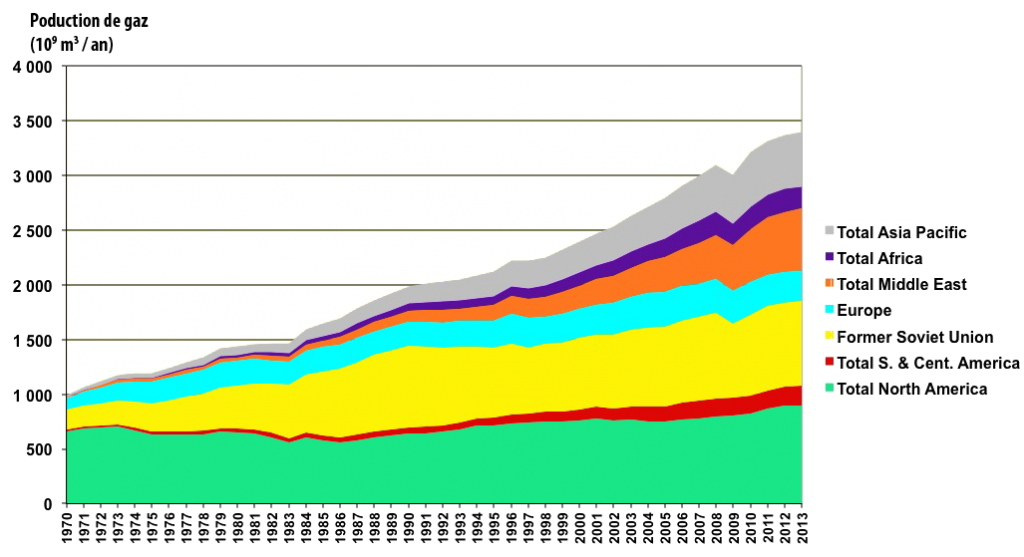

Production by zone in billion cubic metres par year (one billion cubic metres ≈ 0,9 million tonnes oil equivalent).

Source : BP Statistical Review, 2014

Proven reserves therefore do not tell the full story regarding future production…

Who detains the proven reserves?

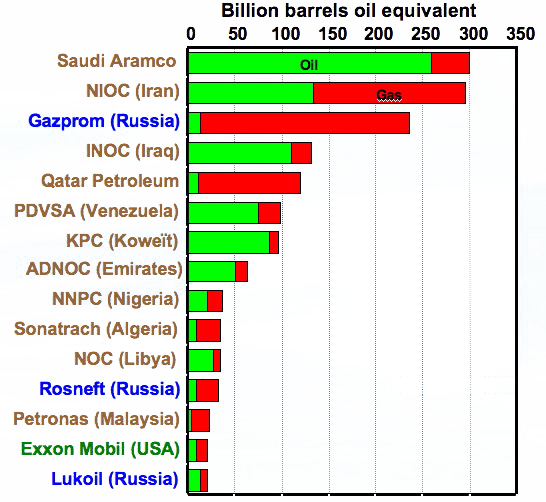

As most companies that produce gas also produce oil and vice versa, it is basically the same companies that detain oil and gas reserves. The graph below shows the top ten owners of reserves.

Largest owners of reserves, oil and gas combined.

State owned companies are in beige, Russian companies in blue (a special category: they are theoretically privately owned, but in practical terms they act as if they were state owned), and privately owned international commanies in green (because they are well-known ecologists!). Exxon, with 1% to 2% of the world total (oil and gas aggregated), is ten times smaller than saudi Aramco, and European majors (BP, Shell, Total), with 1% of the world total in rough figures, do not appear here..

Source : PFC, 2005

Are proven reserves better checked than for oil?

There are no more checks by third parties for gas than there are for oil. Next question?